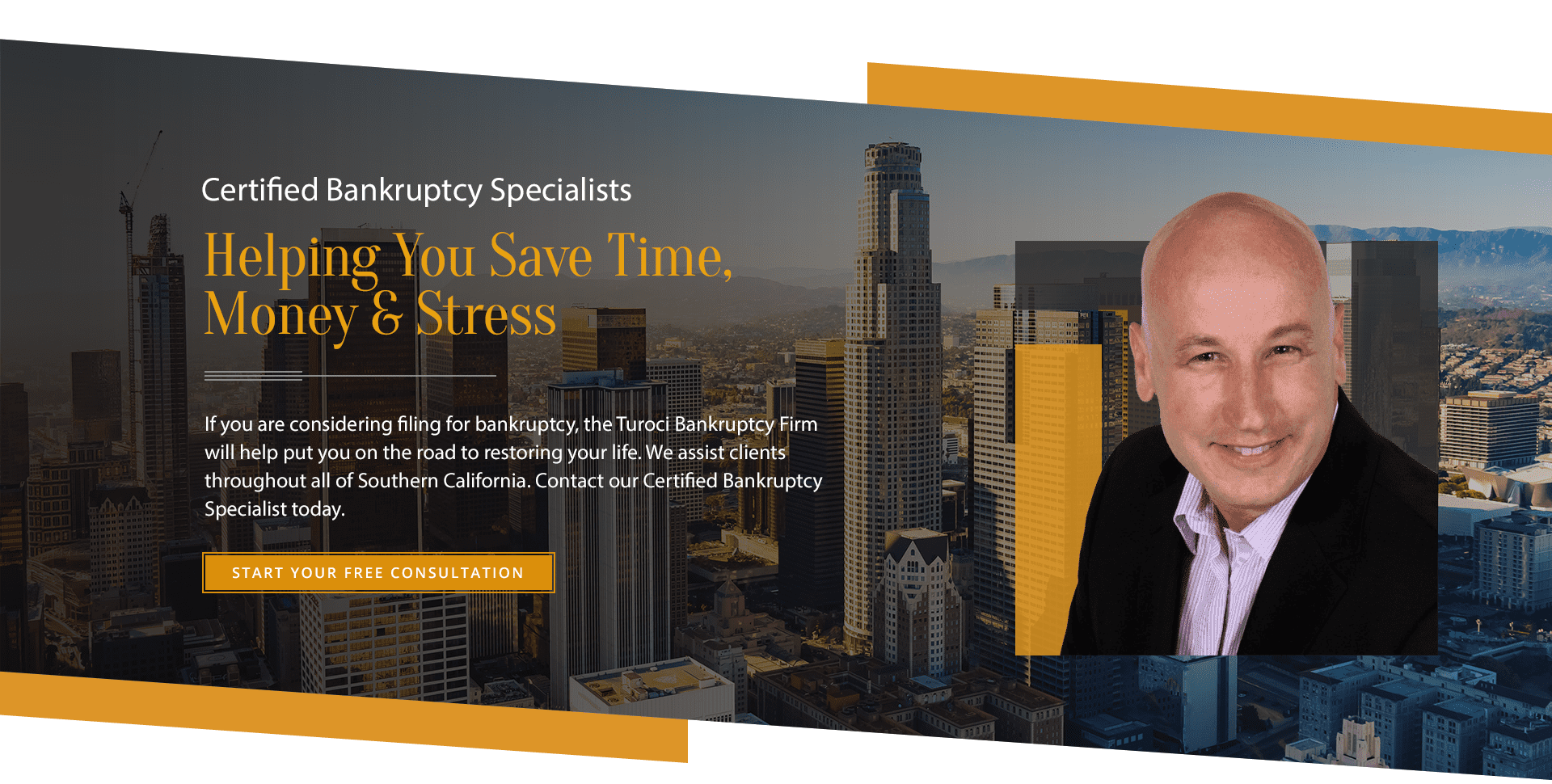

Los Angeles Bankruptcy Lawyer

Serving All of Southern California For Over 30 Years

The Turoci Bankruptcy Firm is owned and operated by Attorney Todd Turoci.

Todd Turoci is one of the few Certified Business Bankruptcy Specialists in the Central District and the only one in the Inland Empire, as Designated by the American Board of Certification.

If you have questions about any bankruptcy or debt-related matter, we are ready to assist you.

Our firm limits its practice to the fields of:

- Bankruptcy

- Insolvency

- Workouts

- And related civil litigation matters

Todd Turoci is one of the few Certified Business Bankruptcy Specialists in the Central District and the only one in the Inland Empire, as Designated by the American Board of Certification.

We can guide you through any type of bankruptcy matter, including:

- Deciding which type of bankruptcy is right for you

- Explaining what type of assets and properties you can keep in bankruptcy

- Explaining which debts you can and can't discharge

- How to stop your home from foreclosure and end creditor harassment

If you have questions about any bankruptcy or debt-related matter, we are ready to assist you.

We primarily represent consumers and businesses as debtors and debtors-in-possession in:

- Chapter 7

- Chapter 11

- Chapter 13

Our professionalism, insight, drive, and tenacity has been derived from our founding attorney’s personal experience serving as a Deputy District Attorney, a Captain in the Marine Corps, and as Judge Pro Tem—ensuring the swift and successful discharge of your bankruptcy case.

No other bankruptcy attorney in Southern California can offer you that same level of bankruptcy experience and success. Our experience is guaranteed to help you save time, money, and stress.

Contact us now to learn more.

Begin the Path to Financial Freedom

The Turoci Bankruptcy Firm will help put you on the road to restoring your lifestyle and enjoying your life debt free.No other bankruptcy attorney in Southern California can offer you that same level of bankruptcy experience and success. Our experience is guaranteed to help you save time, money, and stress.

We have offices in the counties of:

- Los Angeles

- Riverside

- San Bernardino

- And we offer online services for your convenience

Contact us now to learn more.

Considering Filing for

Bankruptcy?

Reaching a point in your life when you have enough debt to consider bankruptcy often comes with significant stress and worry. Let us take this weight off your shoulders by walking you through the entire bankruptcy process. We will help you get your life back on track.

There Are Solutions

Together We'll Find the Right Option for You

Bankruptcy

Debtors who owe more money than they can pay, under federal law, can either eliminate their debts or develop a payment plan to pay all or a portion of their debts over time.

Foreclosure

Foreclosure is the legal right of a mortgage holder or other third-party lien holder to gain ownership of the property and/or the right to sell theproperty.

Wage Garnishment

Once a creditor wins a judgment that remains unpaid; the creditor may obtain wage garnishment. Up to 25% of your paycheck will go to the creditor without ever getting to you.

Client Testimonials

Hear It From the People We Have Helped

The Turoci Difference

Guidance Through the Entire

Bankruptcy Process

Unmatched Experience & Success

Since 1993, we have worked with countless Californians just like you who are struggling with their mounting debt and the intense pressure that comes along with it. We understand what a difficult time you are going through, and we want to help.

Being in debt isn’t something to beat yourself up over—in fact, it’s a common reality for most Americans to some extent. For those with significant debts there are options for consolidating or even discharging it entirely. This is where a Los Angeles Bankruptcy Lawyer like The Turoci Bankruptcy Firm comes in.

At The Turoci Bankruptcy Firm, we take the time to listen to each of our clients' individual struggles and needs to come up with a personalized solution that will get them out of debt as efficiently and painlessly as possible. We recognize that everyone’s situation is different, so we listen carefully to your individual needs and take your input into account throughout the entire process.

If you are too busy to come to our office in person, we will work with you over the phone and allow you to complete processes online or by mail when available. We seek to provide the most comfortable and convenient solutions so that you can get debt free without adding more hardship to your life.

Bankruptcy may be a stressful and challenging process, but it is also a path to a new life—one without the stress and shame you may have already been experiencing for months or even years. You may even be able to take advantage of a bankruptcy alternative to get yourself out of debt.

Whatever you need, we are here to make your goals become a reality. Learn more about what it’s like to work with us at the link below.

![inland-empire[2]](https://turocifirm.com/wp-content/uploads/sites/17/2023/01/inland-empire2.png)